|

People often change their job in the summer. If you look for a job in the same line of work, you may be able to deduct some of your job search costs. Here are some key tax facts you should know about if you search for a new job:

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights.

Comments

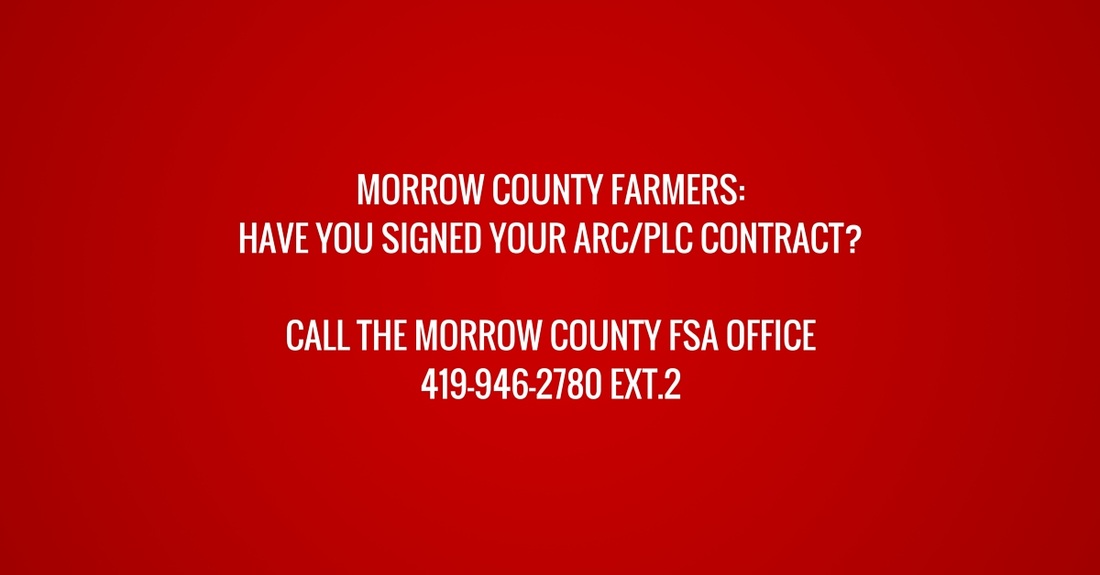

Farmers should check with the Morrow County Farm Service Agency to see if they have signed their 2014 & 2015 ARC/PLC contracts. Because of the numerous steps to complete sign-up into the Farm Program this year, many producers believe they have already completed sign-up. Actually, signing contracts by September 30th is the final step. MANY producers have not done this yet in Morrow County. It is extremely important to sign contracts on your farms for 2014 and 2015 by the up-coming deadline. Please call the Morrow County FSA Office at 419-946-2780 ext.2 to schedule an appointment or to confirm you have signed contracts.

WASHINGTON — The Internal Revenue Service today reminded truckers and other owners of heavy highway vehicles that in most cases their next federal highway use tax return is due Monday, Aug. 31, 2015.

The deadline generally applies to Form 2290 and the accompanying tax payment for the tax year that begins July 1, 2015, and ends June 30, 2016. Returns must be filed and tax payments made by Aug. 31 for vehicles used on the road during July. For vehicles first used after July, the deadline is the last day of the month following the month of first use. Though some taxpayers have the option of filing Form 2290 on paper, the IRS encourages all taxpayers to take advantage of the speed and convenience of filing this form electronically and paying any tax due electronically. Taxpayers reporting 25 or more vehicles must e-file. A list of IRS-approved e-file providers can be found on IRS.gov. The highway use tax applies to highway motor vehicles with a taxable gross weight of 55,000 pounds or more. This generally includes trucks, truck tractors and buses. Ordinarily, vans, pick-ups and panel trucks are not taxable because they fall below the 55,000-pound threshold. The tax of up to $550 per vehicle is based on weight, and a variety of special rules apply, explained in the instructions to Form 2290. For more information, visit the Trucking Tax Center. Each year, many people get a larger refund than they expected. Some find they owe a lot more tax than they thought they would. If this happened to you, review your situation to prevent another tax surprise. Did you marry? Have a child? Have a change in income? Some life events can have a major effect on your taxes. You can bring the tax you pay closer to the amount you owe. Here are some key IRS tips to help you come up with a plan of action.

If you get a tax bill from the IRS, don’t ignore it. The longer you wait the more interest and penalties you will have to pay. Here are six tips to help you pay your tax debt and avoid extra charges.

If you are in the U. S. Armed Forces, special tax breaks may apply to you. For example, some types of pay are not taxable. Certain rules apply to deductions or credits that you may be able to claim that can lower your tax. In some cases, you may get more time to file your tax return. You may also get more time to pay your income tax. Here are the top 10 IRS tax tips about these rules.

If you rent a home to others, you usually must report the rental income on your tax return. However, you may not have to report the rent you get if the rental period is short and you also use the property as your home. In most cases, you can deduct your rental expenses. When you also use the rental as your home, your deduction may be limited. Here are some basic tax tips that you should know if you rent out a vacation home.

If you play the ponies, play cards or pull the slots, your gambling winnings are taxable. You must report them on your tax return. If you gamble, these IRS tax tips can help you at tax time next year.

If you’re preparing for summer nuptials, make sure you do some tax planning as well. A few steps taken now can make tax time easier next year. Here are some tips from the IRS to help keep tax issues that may arise from your marriage to a minimum.

|

AuthorJessica Clark has over 12 years experience in the accounting industry. Archives

November 2016

Categories |

RSS Feed

RSS Feed